Can the Nakamoto Upgrade and sBTC Empower Stacks to Further Lead the Bitcoin Ecosystem?

Bitcoin breaking $100,000 seems to be just around the corner, and the community is eagerly anticipating the development of the Bitcoin ecosystem.

Although the performance of related ecosystem tokens has not been dazzling, U.S. compliant trading platforms such as Coinbase and Kraken have recently issued cbBTC and KBTC respectively. Industry giants' exploration of the Bitcoin ecosystem has never stopped. Whether compared to other chains or its own nearly $2 trillion market capitalization, the Bitcoin ecosystem still has a long way to go but also holds tremendous development opportunities.

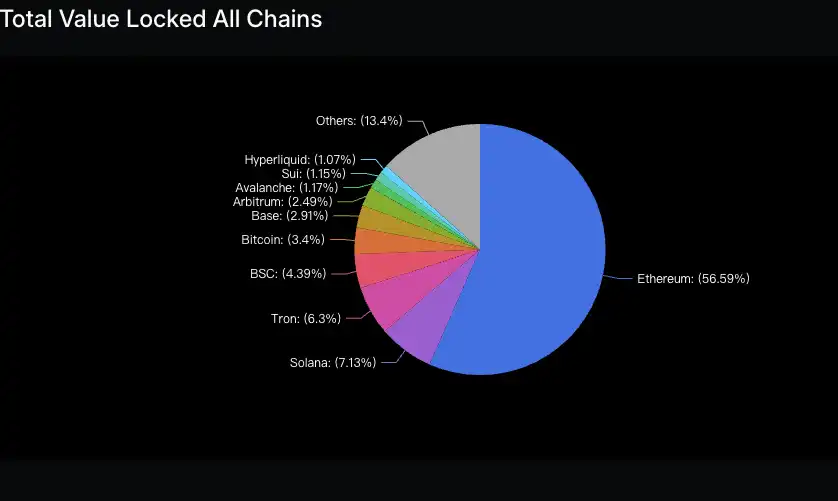

Percentage of total TVL each chain holds, with the Bitcoin ecosystem accounting for only 3.4%

From a secondary market perspective, hot money in the market has always had the need for race rotation and switching from highs to lows. In the Bitcoin ecosystem, Stacks, as a leader in this field, has become the best representative of exploration in the Bitcoin ecosystem. Stacks has continuously built technology and ecosystem from scratch, which is particularly solid and impressive in the current market environment.

Recently, the Ripple and SEC case has come to a temporary conclusion, coupled with the resignation of the SEC chairman triggering a super bull market for XRP. Like Ripple, Stacks is also a compliant representative in the crypto industry. In July 2024, the U.S. Securities and Exchange Commission (SEC) terminated its investigation into Stacks and Hiro. Moreover, Stacks is the first token issuance project ever approved by the SEC.

Stacks' Technological Iteration Journey

The Smart Contract Dream on Bitcoin: From Blockstack to Stacks

Stacks' history can be traced back to Blockstack, founded by Muneeb Ali and Ryan Shea from Princeton in 2013. Blockstack, as the initial v1 version, aimed to create a decentralized Internet ecosystem, replacing traditional cloud computing with a distributed computing network. At that time, Blockstack had a large number of DApps.

By 2021, Blockstack's v2 version, now known as the Stacks mainnet, was officially launched. At this point, the team's goal underwent a significant transformation—from serving a decentralized Internet to empowering Bitcoin. Through the Stacks protocol, developers can build applications with smart contract functionality on the Bitcoin network without altering Bitcoin itself. Throughout this process, Stacks inevitably faced criticism from Bitcoin "maximalists," but Muneeb consistently and tirelessly conveyed the vision of Stacks to the community.

PoX and Clarity: Deeply Integrating Bitcoin with Stacks

The reason Stacks can securely integrate with Bitcoin is thanks to its innovative Proof of Transfer (PoX) consensus mechanism. At the core of the PoX mechanism is the idea of allowing miners to participate in Stacks block mining by transferring Bitcoin, rather than relying on competitive hash power expenditure. This way, Stacks not only inherits the security of the Bitcoin network but also makes Bitcoin holders direct participants in the ecosystem.

Compared to traditional Proof of Stake (PoS), the design philosophy of PoX is more in line with the decentralization spirit of Bitcoin. In a unique way, it transfers the value of Bitcoin to the Stacks ecosystem, creating a close economic bond between the two. For miners, the PoX mechanism provides a new way to capture value, and for developers, this deep integration also gives them greater confidence when implementing smart contracts on the Bitcoin network.

Alongside the launch of the Stacks mainnet came Clarity, a smart contract language designed specifically for Bitcoin. Clarity is a non-Turing complete language, meaning it focuses on implementing verifiable functions while avoiding the uncertainty of complex computations. When using Clarity, developers can preview the outcome of smart contracts in advance, greatly reducing the risk of unexpected behavior. Additionally, Clarity runs directly on the chain, avoiding vulnerabilities that traditional smart contract compilers may introduce. This language designed for Bitcoin lays the foundation for DeFi, NFTs, and other complex applications.

Nakamoto Upgrade: Faster, More Stable, More Secure

Just as there is no perfect code, Stacks also has room for improvement on its journey to expand Bitcoin.

The original design of Stacks tied block production to Bitcoin blocks, causing slow block production to result in high latency, where even microblocks could not completely solve the problem. Furthermore, the security of the Stacks network was not entirely tied to Bitcoin, as the cost of reorganizing the last N blocks of the Stacks blockchain was the cost of generating the next N + 1 Stacks blocks. This cost was lower compared to a 51% attack on Bitcoin.

Given this, in 2024, Stacks introduced the "Nakamoto Upgrade" and officially completed the upgrade on October 29th. The significance of this upgrade goes beyond technical optimization; it is a crucial step towards the prosperity of the Bitcoin ecosystem.

In the just-concluded month of November, the on-chain transaction volume of Stacks hit a recent high

Rapid Block Confirmation: Optimizing User Experience

The Nakamoto Upgrade introduces a rapid block confirmation mechanism, allowing users to achieve near real-time transaction confirmation on Stacks. Microblocks and Bitcoin anchor blocks will be eliminated, replaced by continuously produced Stacks blocks, enabling miners to produce multiple blocks during a Bitcoin block, significantly improving transaction speed.

The time required for a user-submitted transaction to be confirmed in a block is now reduced from 10 to 40 minutes to approximately 5 seconds, not only improving network efficiency but also opening the door to high-frequency trading and instant payment scenarios.

Bi-Directional Verification: Enhancing Security

Post-upgrade, Stacks has implemented a bi-directional verification mechanism, requiring miners to be active on both the Bitcoin and Stacks networks simultaneously. This design enhances network security while ensuring the collaborative relationship between the two chains. For attackers to manipulate Stacks data, they must control the consensus of the Bitcoin network concurrently, significantly raising the cost. This upgrade also addresses the MEV problem by modifying the cryptographic selection algorithm, ensuring Bitcoin miners cannot unfairly gain block rewards due to their advantage. It increases the cost for Bitcoin miners to participate in Stacks mining, requiring them to invest resources comparable to other miners.

sBTC and the Stacks Ecosystem: Unlocking Bitcoin's Potential

Following the Nakamoto Upgrade, sBTC, which is included in the 2023 release roadmap, is set to launch as planned. According to the latest updates, the sBTC testnet phase has been successfully completed, and the mainnet launch will follow a three-stage roadmap:

Phase 1 (expected launch on December 16, 2024): Introducing the feature for users to deposit BTC and mint sBTC, with early depositors eligible for participation in the sBTC reward program.

Phase 2 (expected launch 6-8 weeks after Phase 1, between February 1-15, 2025): Unlocking sBTC withdrawal functionality, allowing users to convert sBTC back to BTC.

Phase Three (Specific Time TBD): Open Signer Pool, gradually forming a fully decentralized, open, permissionless signer network.

sBTC Design and Operation Principles

The core of sBTC lies in its decentralized design, avoiding the trust risks of traditional centralized custody solutions. Through a Dynamic Signer Group, sBTC ensures the security and transparency of the exchange process between Bitcoin and sBTC. Users lock BTC on the Bitcoin network and can mint an equal amount of sBTC on the Stacks chain. When redemption is needed, users burn sBTC to release the corresponding amount of BTC. This process is entirely managed by smart contracts, ensuring the transparency and security of operations. sBTC has an Elite Signer Network, including industry leaders such as Blockdaemon, Kiln, Luganodes, Copper, Figment, and more.

sBTC Advantages and Innovations

sBTC's design incorporates multiple innovations, demonstrating significant advantages. Firstly, it employs a Dynamic Signer Group for management, completely avoiding the risks associated with traditional centralized custody solutions, aligning closely with Bitcoin's decentralized principles. Secondly, sBTC grants programmability to Bitcoin, enabling seamless interaction with smart contracts on Stacks. Additionally, all sBTC operations are carried out through Clarity smart contracts, ensuring users can transparently understand every process and state. This transparency not only reduces trust costs but also further enhances the security of operations, providing users with greater assurance.

sBTC's Impact on the Stacks Ecosystem

Recently, wBTC has faced community criticism, with BA Labs proposing in August to lower wBTC's liquidation threshold to 0% on Sky (formerly MakerDAO). However, after discussions with BitGo, the decision was made to indefinitely suspend this separation plan. Coinbase recently decided to delist wBTC. Perhaps influenced by the events mentioned above, wBTC's TVL has also dropped from 152,000 BTC in August to the current 136,000 BTC.

As mentioned earlier, sBTC's early stages include incentive plans. Perhaps sBTC can rely on internal and external efforts to not only fill the existing BTC market gap on-chain but also attract more native bitcoins to participate in the L2 and DeFi space, injecting strong vitality into the Stacks ecosystem. sBTC enables Bitcoin programmability, allowing it to engage in various DeFi applications, including decentralized lending, yield farming, and synthetic asset trading, greatly enriching the diversity of the Stacks ecosystem. Furthermore, sBTC provides developers with a fresh opportunity to build complex applications on the Bitcoin network, stimulating the emergence of more innovative ideas and further driving the rapid development of the Stacks ecosystem. Through sBTC, Bitcoin has successfully transformed from a single-value storage tool into a programmable asset.

Stacks Ecosystem New Developments

The world's leading Bitcoin ATM operator, Coinflip, has announced its integration with Stacks, planning to support sBTC to enhance Bitcoin's programmability and accessibility. sBTC will also land on Aptos Network and Solana to further strengthen Bitcoin's role in the evolving cross-chain DeFi ecosystem. Through Stacks' Best & Brightest event, Immunefi has announced a collaboration with Asymmetric Research and Bitcoin L2 Labs aimed at enhancing the security of sBTC through the upcoming "Attackathon" hackathon event, promoting seamless transfer of Bitcoin between the main chain and Stacks.

The Bitcoin accelerator Bitcoin Frontier Fund (BFF) has announced plans to invest in teams building projects utilizing sBTC. The Stacks on-chain lending protocol Zest also announced this year the completion of investments from participants such as Tim Draper, Binance Labs, Bitcoin Frontier Fund, and Flow Traders.

By 2024, the TVL of the Stacks ecosystem has also seen significant growth, mainly supported by the liquidity staking protocol StackingDAO, the DEX ALEX, and the lending platform Zest. In addition to the aforementioned prominent projects, the Stacks ecosystem also includes the overcollateralized stablecoin protocol Arkadiko, the domain platform .locker, the tool Console serving DAOs, the NFT platform Gamma, the Bitcoin-supporting payment system GoSats, and Skullcoin introducing On Chain Game to Stacks. Not only existing projects, but also in a recent Harvard hackathon hosted by EasyA in collaboration with Stacks, the number of Bitcoin-related projects reached a record high.

With the gradual rollout of sBTC, the Stacks ecosystem will see more innovation and development. In the future, Stacks plans to further optimize network performance, reduce transaction costs, increase throughput, attract more developers and users, and build a comprehensive Bitcoin smart contract ecosystem. Through collaborations with other blockchain networks, Stacks and sBTC are poised to be widely adopted globally, driving the prosperity of the Bitcoin ecosystem.

You may also like

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

Billionaire Michael Saylor’s Strategy Buys $75M of More Bitcoin – Bullish Signal?

Key Takeaways Michael Saylor’s firm, Strategy, has significantly increased its Bitcoin holdings by acquiring an additional 855 BTC…

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…