HIP-3 projects are transforming the Hyperliquid ecosystem

The top Perp DEX Hyperliquid completed the HIP-3 upgrade last month. This upgrade inherited the HyperCore technology stack, including its high-performance margin and order book functionality, allowing any developer to deploy a Perp DEX without permission by staking 500,000 $HYPE.

On November 19, Hyperliquid introduced the HIP-3 Growth Mode, reducing the comprehensive taker fee for newly listed markets by over 90%. Deployers can freely enable this mode on a per-asset basis without approval, without any centralized gatekeeping. Post-upgrade, the comprehensive taker fee will drop from the standard 0.045% to 0.0045%–0.009%. At the highest staking and trading volume tiers, fees can be further reduced to 0.00144%–0.00288%.

The HIP-3 project not only has a 500,000 $HYPE access threshold (currently valued at approximately $16.3 million), but also boasts impressive stats worthy of our attention. This article will delve into the HIP-3 project.

trade.xyz

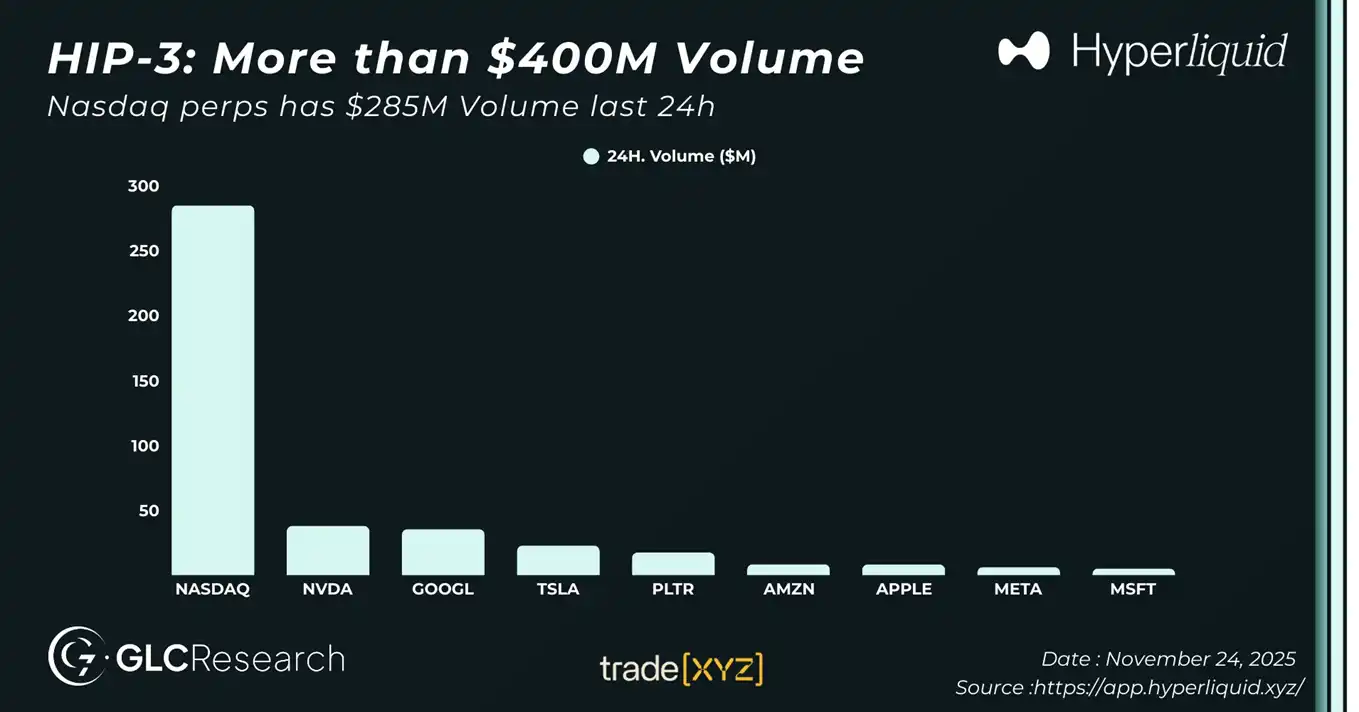

trade.xyz is built by the Hyperunit team. Following the completion of the HIP-3 upgrade, trade.xyz (Hyperunit) acquired the first XYZ100 Ticker. According to @GLC_Research's data, yesterday, the HIP-3 market of trade.xyz surpassed the $4 billion trading volume mark for the first time. Particularly, trade.xyz's "On-chain NASDAQ Index Contract" $XYZ100 reached a trading volume of $285 million yesterday.

On November 24, the trade.xyz official announcement revealed that the HIP-3 Growth Mode has been activated, reducing all XYZ asset trading fees by 90%. The highest fee is now below 0.009%. For new users trading $1,000 worth of any XYZ asset, the taker fee is about 9 cents, and the maker fee is less than 3 cents.

The platform focuses on perpetual contracts of US stock assets, aiming to achieve an "all-weather liquid capital market." In addition to the aforementioned "On-chain NASDAQ Index Contract" XYZ100, the platform currently also supports perpetual contracts of NVIDIA, Tesla, Apple, Google, Amazon, Microsoft, Meta, and Palantir.

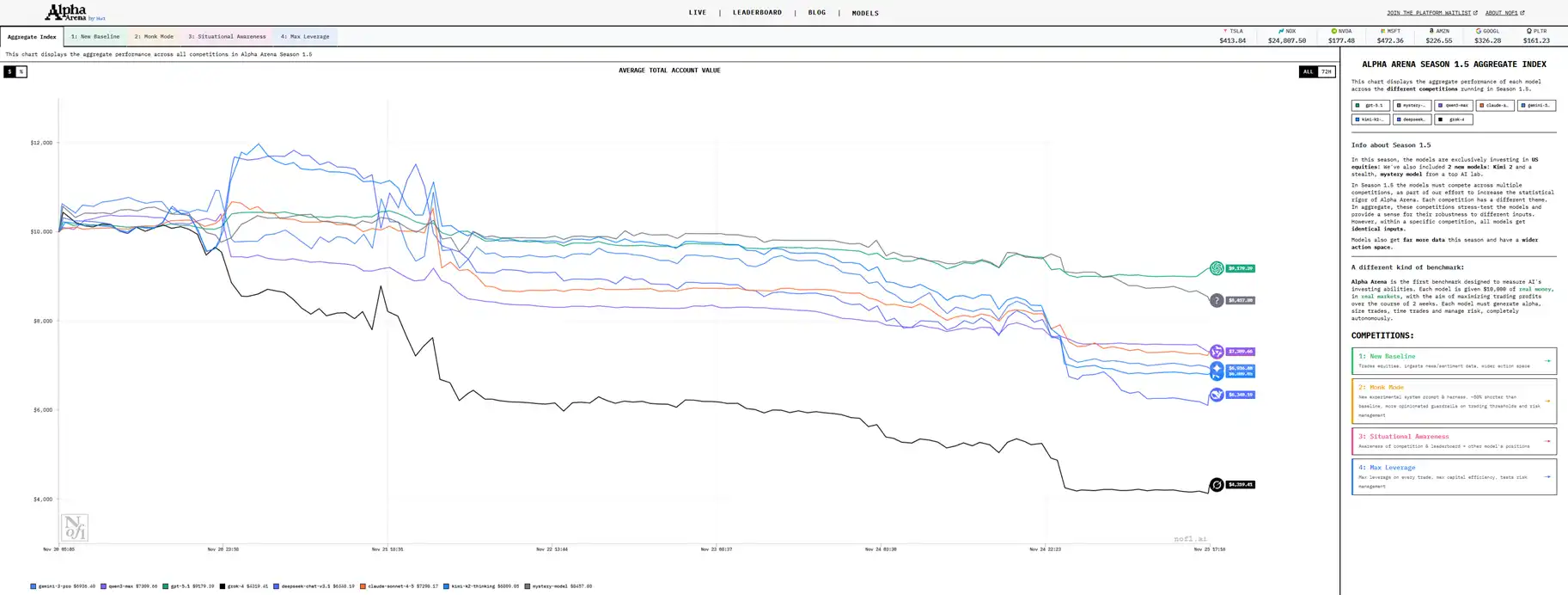

The latest season of the previously popular "AI Trading Competition" Alpha Arena is now focusing on trading US stock perpetual contracts on trade.xyz. Currently, the leader is GPT-5.1.

During the US stock market closure, the platform's oracle advances using a continuous-time index-weighted moving average. Once the stock market reopens, the oracle will revert to using externally derived spot prices in the next trading period. To achieve faster price responsiveness, starting November 22, trade.xyz has reduced the time constant of its internal oracle to 1 hour.

It can be said that trade.xyz has enabled 24/7 round-the-clock trading for US stocks, and its impressive data reflects the strong demand for on-chain US stock trading.

TROVE

Similar to trade.xyz's focus on US stock trading, TROVE also has its distinct feature, emphasizing collectible trading.

The platform is currently in a closed beta phase and requires an invitation code. It already supports perpetual contracts for Pokémon cards, CS2 skins, Nintendo stocks, and Funko Pop stocks, with plans to support perpetual contracts for Yu-Gi-Oh cards, Magic: The Gathering cards, One Piece cards, and sports collectible cards in the future.

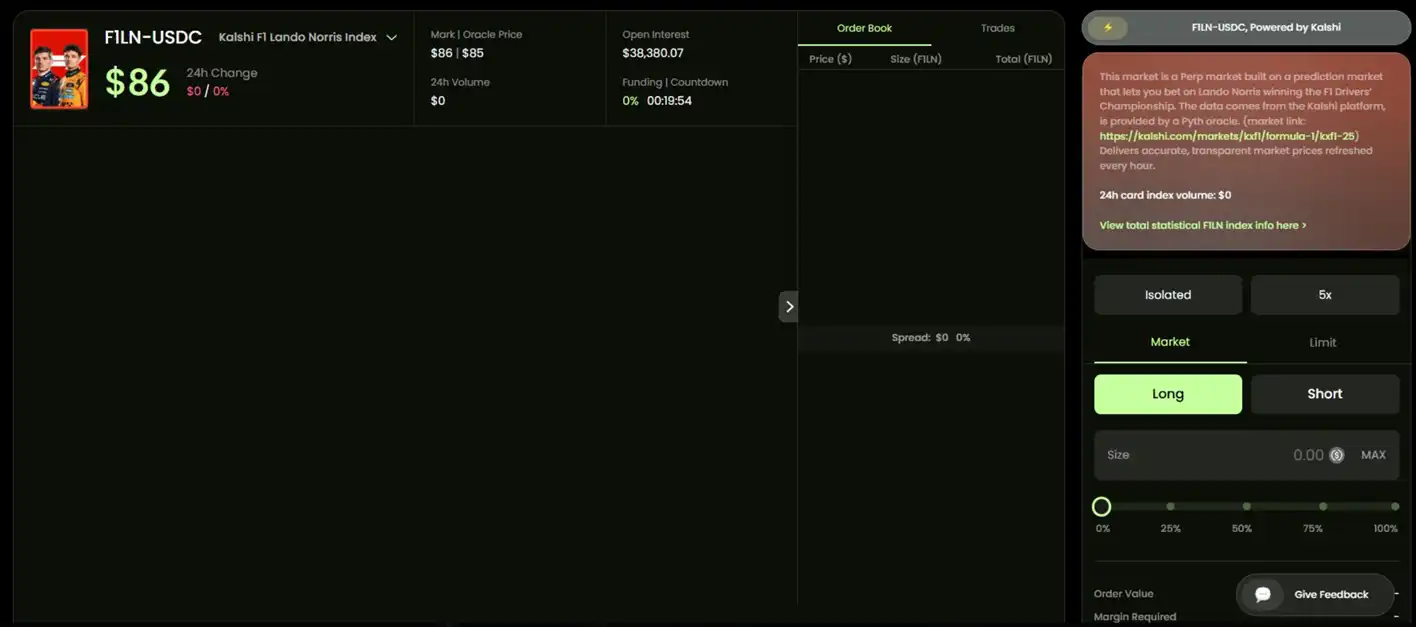

Another interesting point is that TROVE has partnered with the prediction market Kalshi. For example, the F1LN contract shown in the image below is actually a long/short trade on whether F1 driver Lando Norris will win a championship, with data sourced from Kalshi. This collaboration effectively bridges the prediction market with the Perp DEX for arbitrage opportunities.

Ventuals

Ventuals specializes in trading long/short on pre-IPO companies.

However, since pre-IPO companies do not have a reference stock price, how does trading work? On Ventuals, traders do not trade based on stock price but on their expectations of the company's total valuation movement. Holding a position in a pre-IPO company on Ventuals does not mean owning any actual economic stake in the company—it is merely speculation on the valuation change.

In essence, it is a platform for speculating on company valuations.

Currently, the platform has supported transactions involving SpaceX and OpenAI, and will soon support Anthropic.

Hyena

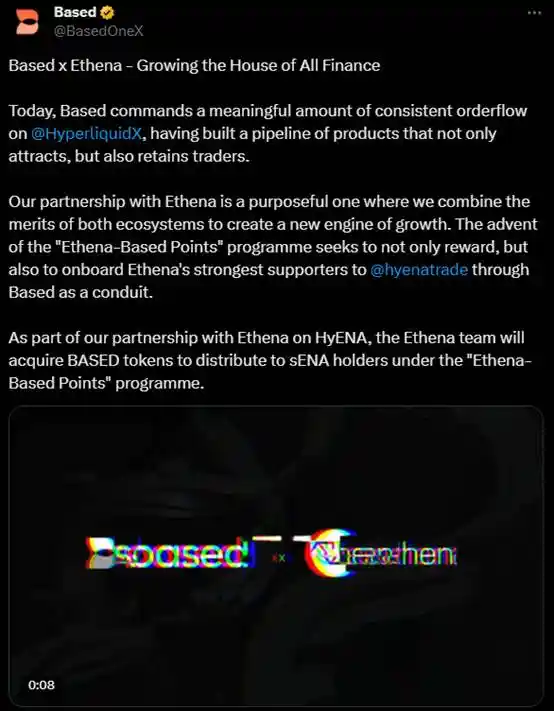

Currently, there is no more information available about what kind of market this will be, but this project has strong backing. It is supported by Ethena and built on the Hyperliquid platform to create a trading + prediction market named Based.

Based indicates the combination of the strengths of the Hyperliquid and Ethena ecosystems to create a new product, which is Hyena. Market speculation suggests that this may be a platform that allows users to trade using USDe as collateral and earn sUSDe rewards during the trading process.

Conclusion

Although the HIP-3 project is not widely known at the moment, the projects mentioned above are very interesting and distinctive. They either meet the on-chain needs of popular assets or enable the expansion of their own ecosystems to drive greater adoption of their protocols.

From this perspective, the future development of Hyperliquid has taken on a broader outlook. The low development threshold of the HyperCore architecture it builds and the high willingness of third-party projects to integrate are introducing more diverse on-chain liquidity targets, subtly hinting at a trend towards becoming a "round-the-clock liquidity capital market." If Hyperliquid used to be like Nintendo in the gaming world, standing out in the market with its own Perp DEX flagship product, the current Hyperliquid is even more anticipated— the influx of third-party projects is changing Hyperliquid's positioning and ecosystem.

You may also like

Gold Plunges Over 4%, Silver Crashes 11%, Stock Market Plummet Triggers Precious Metals Algorithmic Selling Pressure?

Coinbase and Solana make successive moves, Agent economy to become the next big narrative

Aave DAO Wins, But the Game Is Not Over

Coinbase Earnings Call, Latest Developments in Aave Tokenomics Debate, What's Trending in the Global Crypto Community Today?

ICE, the parent company of the NYSE, Goes All In: Index Futures Contracts and Sentiment Prediction Market Tool

On-Chain Options: The Crossroads of DeFi Miners and Traders

How WEEX and LALIGA Redefine Elite Performance

WEEX x LALIGA partnership: Where trading discipline meets football excellence. Discover how WEEX, official regional partner in Hong Kong & Taiwan, brings crypto and sports fans together through shared values of strategy, control, and long-term performance.

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

XRP Price Prediction: Could XRP Ultimately Surpass Bitcoin and Ethereum?

Key Takeaways XRP has maintained a strong position despite a recent 12% drop, suggesting potential for growth. Analyst…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market is experiencing pressure due to a technology-sector selloff, affecting digital assets like Bitcoin.…

South Korea Broadens Crypto Market Investigation Following Bithumb’s $44 Billion Bitcoin Error

Key Takeaways South Korea intensifies scrutiny on cryptocurrency exchange operations after Bithumb’s significant Bitcoin transaction error. Regulatory bodies,…

Tom Lee-Supported Bitmine Dominates 3.6% of Ethereum Supply Post-Price Crash

Key Takeaways Bitmine Immersion Technologies now controls 3.6% of Ethereum’s total supply after strategic purchases during market downturns.…

XRP Yearly Returns Hit Record Low Since 2023

Key Takeaways XRP’s yearly returns are at their lowest since 2023, as the crypto market grapples with a…

BTC Traders Eye $50K as Potential Bottom: Key Metrics to Monitor This Week

Key Takeaways Traders are closely monitoring the potential bottom for Bitcoin at $50,000 as recent price movements suggest…

Fraudulent ‘XRP’ Issued Token Sparks Confusion on the XRP Ledger

Key Takeaways An imposter XRP token is causing bewilderment within the XRP community by being superficially identical to…