Ranger Fund Takes a New Approach to Public Offering: Can a Grassroots Team Earn Market Trust?

Original Title: "Ranger Public Sale Innovates, Can Grassroots Team Be Trusted?"

Original Author: 1912212.eth, Foresight News

On January 6, the project public sale (ICO) of Solana-based DEX aggregator Ranger Finance was officially launched. This public sale was conducted through the MetaDAO platform to raise funds for Ranger's token RNGR, aimed at expanding team capabilities and accelerating development speed.

Currently, the daily derivatives trading volume on Solana, Arbitrum, and Hyperliquid is approximately $500 billion. However, most trading platforms still lock each order into a single venue, leading to liquidity fragmentation, degraded execution quality, and ultimately providing traders with a worse experience. Ranger features a core smart order routing system. It scans integrated venues in real-time, assesses liquidity depth, intelligently splits large orders, and executes trades at the best price.

Ranger Finance also provides an intuitive interface for managing diversified trading positions, with all operations possible on a single platform. The cross-margin support (to be launched soon) system allows multiple assets in a single wallet to be used as collateral, enabling greater flexibility and capital efficiency.

Public Sale Minimum Target $6 Million, Team Performance-Based Unlock

The public sale runs until January 10, with the officially announced minimum fundraising amount set at $6 million, and a monthly spending limit of $250,000 (this amount can be self-allocated monthly by the project founders without needing to submit a proposal to the DAO. The DAO reserves the right to adjust this amount in the future). Ranger token holders have priority in committing funds to the ICO. This priority is distributed proportionally among all token holders, with any remaining portion allocated proportionally to non-token commitors.

If the fundraising amount exceeds the minimum target ($6 million), Ranger will initiate a buyback plan to repurchase tokens within 90 days based on the price difference between the ICO and post-listing, with the repurchased tokens being burned.

Ranger has a total token supply of 25,625,000 tokens, with 10 million tokens in the ICO pool, and existing investors collectively allocated 4,356,250 tokens (linearly vested over 24 months).

It is worth mentioning that the project has set up a performance-based reward system. Team Performance Reward Pool: 7,600,000 tokens (18-month lock-up period, then unlocked based on price milestones at 2x, 4x, 8x, 16x, and 32x from ICO price over a 3-month TWAP).

Ambassadors and Ecosystem Partners: 768,750 tokens (25% immediate unlock, remaining 25% linearly vested over 6 months).

The remaining token supply is designated for providing liquidity, where 20% of the raised funds and 2 million tokens will be deposited into FutarchyAMM, and 900,000 tokens will be unilaterally deposited into Meteora's liquidity pool.

Previously Raised at a $30 Million Valuation

In December 2024, amidst a bullish crypto market, Ranger secured a $1.9 million investment led by RockawayX, with participation from Asymmetric, Big Brain Holdings, RISE Capital, Anagram, and others.

Throughout this year, Ranger not only launched tokenized stocks based on xStocks but also acquired the Voltr protocol in November.

Ranger's team has limited public information available. Co-founder Fathurrahman Faizal is a graduate of Singapore Management University and previously served as COO at SolanaFM. The other co-founder, Barrett Williams, also a co-founder of mtnCapital, has invested in the on-chain order book trading protocol BULK and MetaDAO.

The team allocation accounts for 29.6% of the total supply, with tokens unlocking only upon reaching ICO price milestones (e.g., 2x, 4x, 8x, 16x, 32x FDV). This incentive structure aligns with investor interests and is one of the few highlights. The team emphasizes "no pre-mining" and transparent governance, but the lack of specific relevant links for verification may raise trust issues. The project claims to be built on TechFlow but has not disclosed core developer experience.

Overall, the team's anonymity aligns with DeFi culture, but for a project seeking a multi-million-dollar public raise, this may be a potential risk factor.

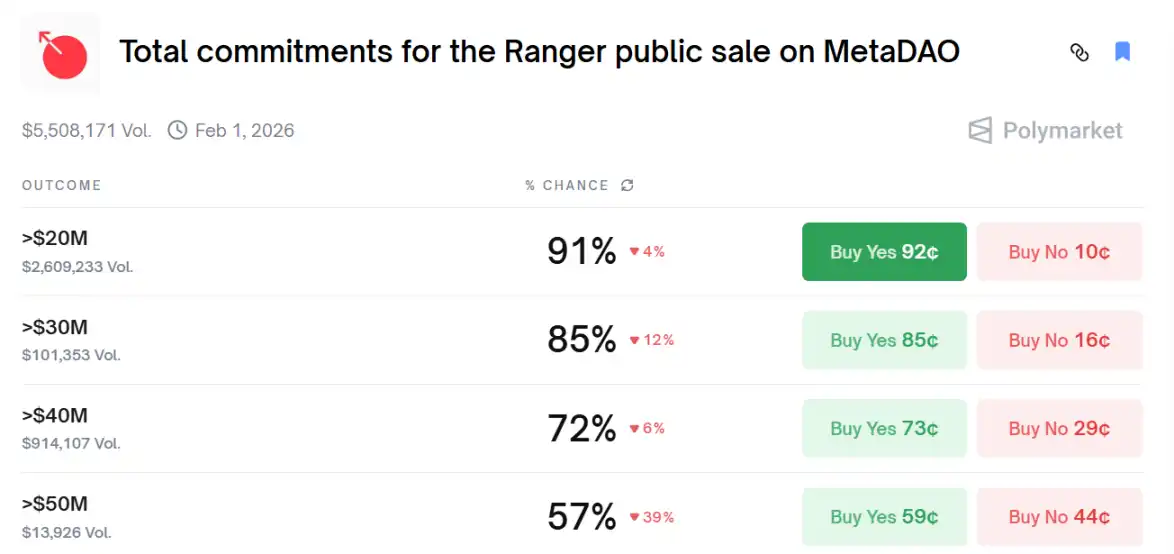

As of now, the official website indicates that their fundraising has reached $2.9 million, with nearly 1,800 investors participating. Polymarket data shows an 85% probability that the public sale subscription amount will exceed $30 million.

You may also like

Why Bitcoin Is Falling Now: The Real Reasons Behind BTC's Crash & WEEX's Smart Profit Playbook

Bitcoin's ongoing crash explained: Discover the 5 hidden triggers behind BTC's plunge & how WEEX's Auto Earn and Trade to Earn strategies help traders profit from crypto market volatility.

Wall Street's Hottest Trades See Exodus

Vitalik Discusses Ethereum Scaling Path, Circle Announces Partnership with Polymarket, What's the Overseas Crypto Community Talking About Today?

Believing in the Capital Markets - The Essence and Core Value of Cryptocurrency

Polymarket's 'Weatherman': Predict Temperature, Win Million-Dollar Payout

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

A nearly 20% one-day plunge, how long has it been since you last saw a $60,000 Bitcoin?

Raoul Pal: I've seen every single panic, and they are never the end.

Key Market Information Discrepancy on February 6th - A Must-Read! | Alpha Morning Report

2026 Crypto Industry's First Snowfall

The Harsh Reality Behind the $26 Billion Crypto Liquidation: Liquidity Is Killing the Market

Why Is Gold, US Stocks, Bitcoin All Falling?

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Tether Q4 2025 Report: USDT Market Cap Nears $190 Billion, Multiple Metrics Reach All-Time Highs

Kyle Samani's about-face, one of the biggest believers in web3, has also left the industry

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Why Bitcoin Is Falling Now: The Real Reasons Behind BTC's Crash & WEEX's Smart Profit Playbook

Bitcoin's ongoing crash explained: Discover the 5 hidden triggers behind BTC's plunge & how WEEX's Auto Earn and Trade to Earn strategies help traders profit from crypto market volatility.

Wall Street's Hottest Trades See Exodus

Vitalik Discusses Ethereum Scaling Path, Circle Announces Partnership with Polymarket, What's the Overseas Crypto Community Talking About Today?

Believing in the Capital Markets - The Essence and Core Value of Cryptocurrency

Polymarket's 'Weatherman': Predict Temperature, Win Million-Dollar Payout

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

Earn

Earn