SignalPlus Macro Analysis: ETH ETF Inflows Rebound, Potentially Fueling Further Altcoin Rally

Original Title: "SignalPlus Macro Analysis Special Edition: Final Stretch"

Original Source: SignalPlus

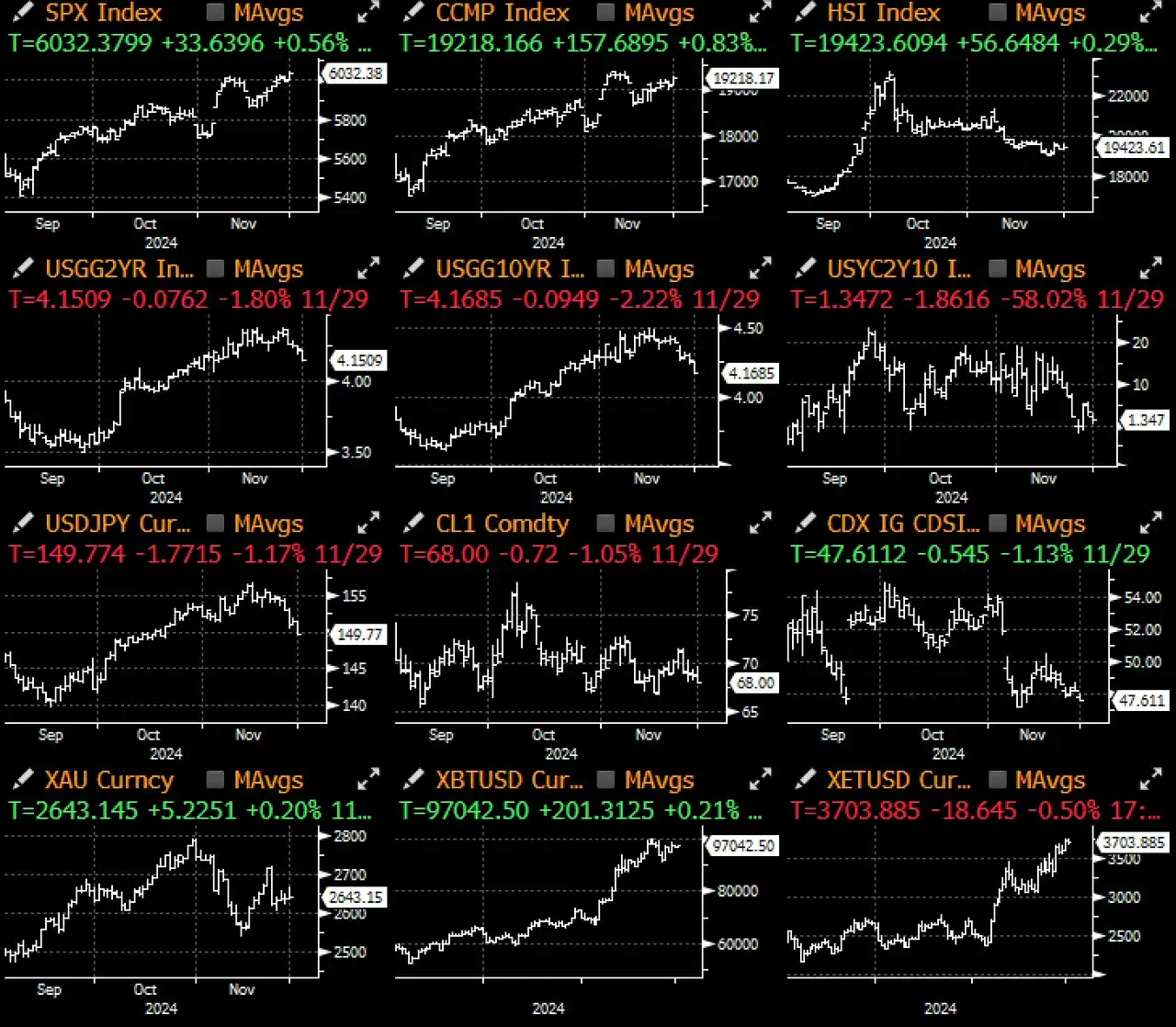

Last week was the Thanksgiving holiday in the United States, with light market trading volume maintaining an overall consolidation pattern. The U.S. stock market is set to make history once again, with 2024 poised to be one of the best-performing years in history, with 5 out of the past 6 years seeing double-digit returns.

Market breadth continues to be supportive, with the 52-week stock high-low quantity difference still appearing healthy. The upward trend remains intact, the volatility index (VIX) is trending downwards, and following Trump's announcement that Scott Bessent will be the Treasury Secretary, the bond market has calmed down, with the 10-year yield dropping nearly 35 basis points from its October high.

In addition to his so-called "pro-cryptocurrency" stance, Bessent is also a fiscal hawk and a supporter of an independent Federal Reserve. His proposed 3-3-3 plan (reduce the fiscal deficit to 3% of GDP, raise real GDP growth to 3%, and increase daily energy production by 3 million barrels) has brought relief to the U.S. fixed-income market. Since his nomination, the yield curve premium has remained stable at the current level.

While there are still doubts about his core views, journalists researching his early speeches have found that due to central bank accumulation, he has a "long-term bullish" view on gold. Whether this will have a spillover effect on Bitcoin, especially in the recent discussions about strategic reserve portfolios, remains to be seen. At the very least, the next four years are sure to be very interesting.

Traders are gearing up for a busy week as they approach the final non-farm payroll data release of the year. Despite concerns about rising inflation just beginning to emerge, the market still anticipates a roughly 65% chance of a rate cut. However, considering the strong economic conditions, the forward rate cut expectations for 2025-2027 have been significantly reduced. Regarding the employment data, the market expects an overall employment data rebound of around +160,000, while the unemployment rate is expected to hover around 4.3%. Given the recent weakness in PMI surveys and high-frequency employment data, the final data outcome also has the potential to come in below expectations. Nevertheless, unless there is an extremely surprising result, risk sentiment may still remain positive.

The optimistic sentiment in the cryptocurrency market continues to prevail. However, this week's focus is on Ripple. Against the backdrop of expectations that the government will withdraw its long-standing lawsuit, XRP has surged a stunning 73%. This significant upward trend has helped XRP surpass USDT to become the third-largest cryptocurrency by market capitalization. In anticipation of this development, whale addresses have been actively accumulating XRP over the past month (and are now selling).

The current uptrend is mainly concentrated in major coins (excluding ETH), with BTC leading the pack, while altcoins are still struggling to return to their January highs. Although recent successes in Layer 2 and blockchain protocol transformations (such as Hyperliquid) continue to dominate the cryptocurrency market's attention, we are seeing some improvement in Ethereum through inflows into ETH ETFs. Last Friday saw inflows exceeding $330 million. Will we see more rebounds of secondary mainstream coins before the year's end?

Nevertheless, the fundamental indicators of cryptocurrency remain optimistic as the market capitalization of stablecoins has finally exceeded the previous high during the Terra-Luna period. Stablecoins are usually the first entry point for most fiat users into the cryptocurrency market, and a higher market capitalization (with a fixed price, hence entirely quantity-driven) indicates greater mainstream participation.

With investors pouring in more new funds, will we see faster growth in the new year? Let's hope so!

You may also like

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

Billionaire Michael Saylor’s Strategy Buys $75M of More Bitcoin – Bullish Signal?

Key Takeaways Michael Saylor’s firm, Strategy, has significantly increased its Bitcoin holdings by acquiring an additional 855 BTC…

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…