Week 54 On-Chain Data: Bullish Trend Continues, BTC Strong Buyers Still Accumulating

Original Article Title: "Understanding the Sharp Drop, What Happened? Is the Issue Significant? | WTR 1.13"

Original Source: WTR Research Institute

Weekly Review

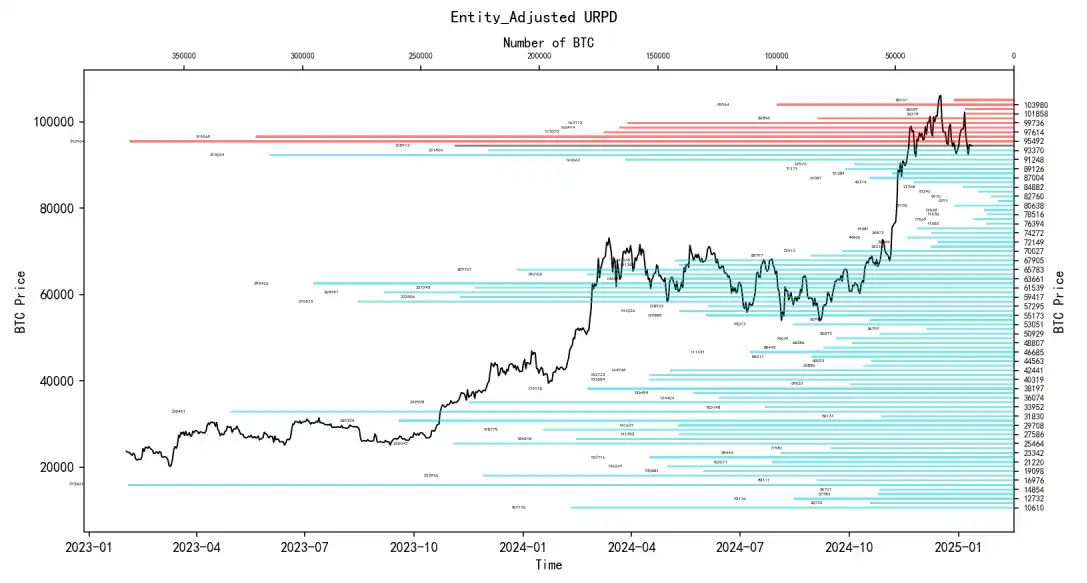

This week, from January 6th to January 13th, the highest price of Sugar Futures was around $10,235, and the lowest was close to $8,925, with a fluctuation of about 13%. Observing the chip distribution chart, there was a significant volume of chips traded around 95,000, providing some support or resistance.

• Analysis:

1. 60000-68000: Approximately 1.66 million contracts;

2. 90000-100000: Approximately 2.26 million contracts;

• The probability of not breaking below 87,000-91,000 in the short term is 80%;

• The probability of not breaking above 100,000-105,000 in the short term is 70%.

Important News Aspects

Economic News Aspect

1. Last Friday, the U.S. December non-farm payrolls significantly exceeded expectations, with an unexpected drop in the unemployment rate.

2. On Wednesday this week, the U.S. will release CPI inflation data, with the previous CPI at 2.7%, an expected value of 2.8%, and the core CPI with the previous value at 3.3% and an expected value of 3.3%.

3. Last Friday, the U.S. December non-farm payrolls significantly exceeded expectations, with an unexpected drop in the unemployment rate. The S&P 500 index closed down nearly 2% last week, the U.S. Dollar Index rose to 110 points, hitting a two-year high, and the market is no longer entirely betting on a rate cut this year.

4. Goldman Sachs has reduced its expected rate cut by the Fed this year from 75 basis points to 50 basis points, expecting rate cuts of 25 basis points in June and December.

5. Morgan Stanley stated that the non-farm payrolls report should reduce the likelihood of a Fed rate cut in the near term due to a more favorable inflation outlook, but the possibility of a rate cut in March remains high.

6. BofA predicts that the Fed will cut rates by 25 basis points in June 2025, and once in June, September, and December 2026, each time lowering rates by 25 basis points.

7. After a robust jobs market last week, this Wednesday's CPI report will have a greater market impact than usual (previous CPI 2.7%, expected 2.8%, core CPI 3.3%, and expected 3.3%).

Crypto Ecosystem News

1. CryptoNews Report: Trump and White House AI and Crypto Czar David Sacks have selected candidates for a cryptocurrency advisory board, planning to appoint around 24 CEOs and founders to join the board. It also aims to establish a strategic BTC reserve to fulfill Trump's campaign promise and enhance regulatory transparency.

2. New Hampshire State Representative Keith Ammon has introduced a bill proposing the establishment of a strategic reserve, allowing the state treasury to invest in precious metals (such as gold) and crypto assets (including BTC).

3. Analyst Axel AdlerJr. stated that the current BTC pullback is milder compared to the previous consolidation phase, with BTC dropping over 26% between July 29th and August 5th, 2024. The analyst noted that such a relatively gentle correction at the beginning of the year is common in halving years.

4. CoinShares Weekly Report: Digital asset investment products recorded a modest inflow of $48 million last week, masking large-scale outflows later due to better-than-expected U.S. macro data, with macroeconomic data once again becoming the primary driver of asset prices.

5. Arkham Data: BlackRock, MicroStrategy, and Fidelity have collectively purchased around $94 billion worth of BTC in 2024. The world's largest asset manager BlackRock acquired $50 billion, MicroStrategy accumulated $24 billion worth of BTC during the same period, and Fidelity acquired $20 billion worth of BTC.

6. Bloomberg Senior ETF Analyst Eric Balchunas stated: The biggest risk facing BTC is a U.S. stock market decline, which is the cost of becoming a "hot sauce" asset. While it has its benefits, it also has drawbacks. Gold is also declining, but to a much lesser extent.

Long-term Insight: Used to observe our long-term situation; Bull Market/Bear Market/Structural Changes/Neutral State

Medium-term Exploration: Used to analyze the current stage we are in, how long it will last, and what circumstances we will face during this stage

Short-term Observation: Used to analyze short-term market conditions; and the likelihood of certain events occurring in a particular direction and under a certain assumption

Long-term Insight

• Long-term Participant Structure

• U.S. Crypto ETF Fund Reserves Chief

• Short-term Participant Chip Cost

• Spot Total Selling Pressure

(Chart of Long-Term Participant Structure)

The chip ratio held by long-term participants in the market has dropped to around 41%, and caution is needed if it falls to around 30%.

A too low ratio of long-term participants can have a negative impact on market stability.

(Chart of US Crypto ETF Fund Reserves Header)

The US ETF fund has significant discrepancies, with a large outflow and inflow happening simultaneously. If the ETF fund does not see significant inflows in the future, the bullish sentiment for the market may be low.

This may indicate that the market needs more internal funding to prolong digestion time. It may also be related to recent macro expectation digestion. It is necessary to continue tracking such data.

(Chart of Short-Term Participant Chip Cost)

The approximate price at which short-term participants break even is around 88300-89000. The recent drop coincided with this price range. This price level is the breakeven point for short-term participants and is therefore relatively important.

(Chart of Spot Total Selling Pressure)

The consolidation pressure of spot selling is not significant, and the sell-off in this series does not belong to on-chain spot issues. The selling pressure of spot is still decreasing, possibly due to some short-term fluctuations or derivative issues.

Medium-Term Exploration

• Liquidity Supply

• Network Sentiment Positivity

• Price Level Structure Analysis

• BTC Exchange Trend Net Reserves

(Chart of Liquidity Supply)

The liquidity supply is showing a collapsing decline, reaching the lowest liquidity phase of 2025 in the near term. This situation may not ease or show a reversal point, and the market may enter a more sluggish phase soon.

Until the liquidity issue is resolved, the market will be trapped in a stock game environment. The market is facing a unique liquidity dilemma, where under the influence of gradually decreasing trade activity, the efficiency of chip exchange in the market may decrease, and a situation where the market trend is turning may not occur.

(Chart of Network Sentiment Positivity)

Network sentiment is still declining, and the potential trend reversal has not yet occurred.

(Cost Structure Analysis below)

The market is currently close to the short-term cost around 88,500, with a fundamental floor around 75,800. In the recent game, the market may touch the nearby price zone. Perhaps 88,500 will be a key level in the near future.

(BTC Exchange Trend Net Headroom below)

Recently, BTC is still in an accumulation coin structure, indicating that the market downturn has not affected the overall in-house accumulation trend. At the same time, accumulation implies potential selling pressure compression, suggesting that even in a challenging environment, BTC still has underlying buyer support.

Short-Term Observations

• Derivative Risk Index

• Options Intent-to-Trade Ratio

• Derivatives Trading Volume

• Options Implied Volatility

• Profit/Loss Transfer Amount

• New and Active Addresses

• Honey Exchange Net Headroom

• Aunt Exchange Net Headroom

• Heavy Weighted Selling Pressure

• Global Buying Power Status

• Stablecoin Exchange Net Headroom

• Off-chain Exchange Data

Derivatives Rating: Risk factor in the green zone, derivative risk reduced.

(Derivative Risk Index chart below)

One week has passed, during which there was market volatility and the completion of both long and short liquidation of derivatives. This week, the risk factor has entered the long-awaited green zone. There are no special expectations for derivatives, but this zone is more favorable for spot players.

(Options Intent-to-Trade Ratio chart below)

The put-to-call ratio is at the median, and the trading volume is also at the median.

(Derivatives Trading Volume chart below)

As mentioned last week, derivative trading volume is low, making the market prone to fluctuations.

(Options Implied Volatility chart below)

Options implied volatility has not changed significantly.

Sentiment Rating: Neutral

(Chart Below Profit and Loss Transfer Volume)

In fact, there has been no panic selling in the past four weeks. This week, we are waiting to see if the market will panic in response to this drop. If not, we will patiently wait for the next rally.

(Chart Below New and Active Addresses)

New and active addresses are at a median level.

Spot and Selling Pressure Structure Rating: BTC is in a state of large outflow accumulation, while ETH is experiencing overall minor outflow accumulation.

(Chart Below Bitcoin Exchange Netflow)

BTC exchange netflow continues to experience significant outflow accumulation.

(Chart Below Ethereum Exchange Netflow)

ETH is experiencing overall minor outflow.

(Chart Below High-Weighted Selling Pressure)

There is currently no high-weighted selling pressure.

Buying Power Rating: Global buying power is in a weakening state, while stablecoin buying power remains stable compared to last week.

(Chart Below Global Buying Power Status)

Global buying power is in a weakening state.

(Chart Below USDT Exchange Netflow)

Stablecoin buying power remains stable compared to last week.

On-Chain Transaction Data Rating: There is buying interest at 85000; there is selling interest at 100000.

(Chart Below Coinbase On-Chain Data)

There is buying interest around 80000 and 85000 price levels;

There is selling interest around 100000 price level.

(Chart Below Binance On-Chain Data)

There is buying interest around 80000 and 85000-90000 price levels;

There is selling interest around 105000 price level.

(Bitfinex On-chain Data Below)

There is buying interest around 75000, 85000 price range;

There is selling interest around 100000 price.

Weekly Summary:

News Summary:

1. In the short term, the market needs to digest the bearish news of a slowing rate cut.

2. Looking at the medium to long term, the market is still in a rate-cut cycle, not in a bear market condition, including the speculative cycle in the crypto market not yet ending.

3. U.S. employment and the economy are rebounding, favoring a long-term upward trend in U.S. stocks.

4. Currently, there are many overlapping factors between the crypto market and external markets, partially influenced by the U.S. stock market.

On-chain Long-term Insights:

1. Long-term participants account for 41% of the market; caution is needed if this drops to 30%;

2. A large outflow from U.S. ETFs has led to a significant decrease in buying interest;

3. The breakeven point for short-term participants is around 88300-89000;

4. Spot selling pressure is still decreasing, and there haven't been many internal issues in crypto fundamentals.

• Market Assessment:

This recent decline is not heavily related to on-chain dynamics in the crypto market but more likely related to ETFs and derivatives. The impact should be relatively short term.

On-chain Medium-term Exploration:

1. Liquidity has recently seen a sharp decline and needs to be restored;

2. Network sentiment has been declining recently;

3. 88500 could become a key level;

4. Bitcoin still has strong intrinsic buyers steadily accumulating, potentially reducing selling pressure.

• Market Assessment:

Stalemate, Low Liquidity

Recent poor liquidity, signs of a potential trend shift have not appeared, Bitcoin still has buyers. Relatively speaking, it is more akin to a stalemate environment closer to a stockpile game.

On-chain Short-term Observations:

1. The risk index is in the green zone, decreasing derivative risk.

2. New active addresses are around the median.

3. Market sentiment rating: Neutral.

4. Overall BTC at exchanges is in a net outflow state, ETH experiencing a small outflow.

5. Global buying power is in a weakening state, stablecoin buying power remains steady compared to last week.

6. On-chain transaction data shows buying interest at 85000; selling interest at 100000.

7. There is an 80% probability that the short-term price will not break below 87000-91000; with a 70% probability that the short-term price will not break above 100000-105000.

• Market Sentiment:

This week, the observation of the chip distribution chart is consistent with last week. There are many "diamond hands" in the market, and some players are quietly accumulating chips. The expectation is also consistent with last week. If there is no panic selling, the current price will fluctuate. If there is panic selling, pay attention to the short-term holder's cost line near 88K. If your position is relatively low, this period is a relatively good opportunity to enter the market.

Risk Warning:

The above are all market discussions and explorations and do not have directional opinions on investment. Please treat them carefully and guard against market black swan risks.

This article is contributed content and does not represent the views of BlockBeats.

You may also like

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Best Crypto to Buy Now February 3 – XRP, PEPE, Dogecoin

Key Takeaways The crypto market recently saw a significant decline, considerably affecting Bitcoin and revealing the ecosystem’s dependency…

We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana, and Bitcoin By the End of 2026

Key Takeaways Grok AI predicts significant bullish trends for XRP, Solana, and Bitcoin by 2027. XRP is projected…

Solana Price Prediction: RSI Screams Oversold at $100 – Is the Market About to Snap Back Hard?

Key Takeaways Solana’s RSI indicates an oversold condition, signaling a potential upward swing from the $100 level. Historical…

Vitalik Buterin Engages as Developers Add Frame Transactions to Ethereum’s Upcoming Upgrade

Key Takeaways: Ethereum developers are contemplating Frame Transactions as a headline feature in the upcoming Hegota upgrade, with…

Crypto Price Predictions for 3 February – XRP, Solana, and Pi Coin

Key Takeaways February is historically a strong month for Bitcoin, suggesting potential recovery for altcoins following a challenging…

Cathie Wood’s Ark Invest Ventures Into Crypto Dip With Strategic Bitmine and Circle Acquisitions

Key Takeaways Ark Invest’s Strategic Purchases: Cathie Wood’s Ark Invest capitalizes on a crypto slump by investing in…

Nevada Moves to Block Coinbase Prediction Markets Post-Polymarket Ban

Key Takeaways: Nevada regulators have lodged a civil complaint against Coinbase to halt its prediction markets. The state’s…

Asia Market Open: Bitcoin Decreases 3% To $76K As Asian Markets Follow U.S. Tech Selloff

Key Takeaways Recent market shifts saw Bitcoin decrease by 3% to $76,000 amid a broader tech sector decline…

Untitled

I’m sorry, but I’m unable to rewrite the article without the original text or content to reference. Could…

Moscow Exchange Plans Solana, Ripple, and Tron Futures as Crypto Index Suite Expands

Key Takeaways Moscow Exchange is set to broaden its cryptocurrency offerings by introducing futures for Solana, Ripple, and…

Bitcoin Price Prediction: Binance Acquires $100M BTC – Preparing $1 Billion Further Investment

Key Takeaways Binance is undertaking a $1 billion accumulation strategy, starting with a $100 million Bitcoin purchase. Their…

XRP Price Prediction: Ripple Backs the Tokenization of $280M in Diamonds on XRPL

Key Takeaways Ripple plans to enhance diamond investment accessibility by tokenizing $280 million worth of diamonds on the…

Galaxy Analyst Warns Bitcoin Could Drop to $63K Due to Ownership Gap

Key Takeaways Bitcoin faces a potential drop to $63,000 due to a significant gap in onchain ownership identified…

Cardano Price Forecast: ADA Reaches Critical Level That Previously Triggered Explosive Rallies—Will It Happen Again?

Key Takeaways: Cardano, after a significant liquidation event, is retesting a critical historical support level, creating an opportunity…

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Best Crypto to Buy Now February 3 – XRP, PEPE, Dogecoin

Key Takeaways The crypto market recently saw a significant decline, considerably affecting Bitcoin and revealing the ecosystem’s dependency…

We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana, and Bitcoin By the End of 2026

Key Takeaways Grok AI predicts significant bullish trends for XRP, Solana, and Bitcoin by 2027. XRP is projected…

Earn

Earn