The Possibility of a Fed Chair Bringing a Wild Bull Run

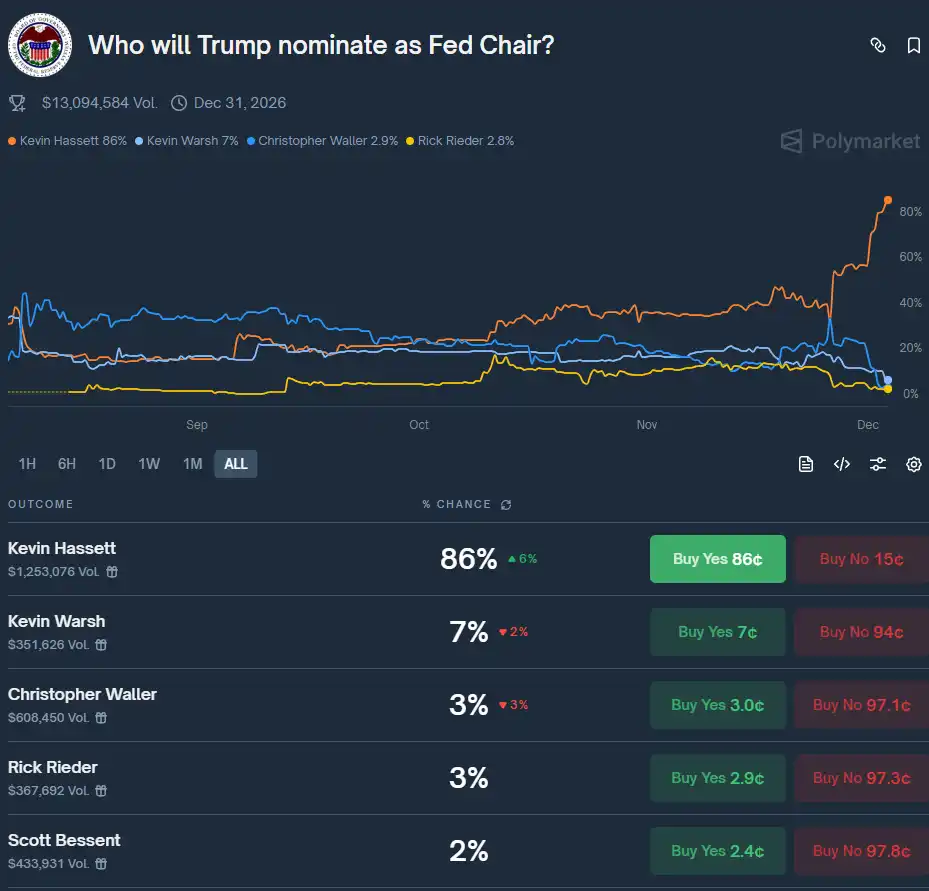

In the prediction market Polymarket, the probability of Hassett being elected as the new Federal Reserve Chair has risen to 86%, far ahead of other possible candidates for the position.

As expected, Kevin Hassett will most likely be the next Federal Reserve Chair, Trump's favorite.

The actions of the Federal Reserve have always been a key factor impacting the cryptocurrency market. So, if Hassett eventually becomes the new Federal Reserve Chair as expected by the market, what kind of impact can be expected on the market?

Accelerated Interest Rate Cuts

In late November, Hassett mentioned that pausing interest rate cuts at that time would be "a very bad time" because the government shutdown had already dragged down fourth-quarter economic growth. He projected that the government shutdown would cause a 1.5 percentage point decline in fourth-quarter Gross Domestic Product (GDP). Additionally, he noted that the September Consumer Price Index (CPI) showed better-than-expected inflation performance.

Earlier on November 13, Hassett stated that he expected a 1.5% GDP decline in the fourth quarter due to the government shutdown. He couldn't see many reasons not to cut interest rates.

Therefore, if Hassett becomes the new Federal Reserve Chair, it is expected that he will advocate for faster rate cuts, potentially lowering the federal funds rate to below 3%, even approaching 1%, to stimulate economic growth and employment.

This is also what Trump wants to see.

Resuming QE (Quantitative Easing)

On December 1, the Federal Reserve officially ended its Quantitative Tightening (QT) policy, marking the end of the balance sheet reduction process that began in 2022. Although some believe that the effects may not be seen until early next year, the expectation of loose liquidity is gradually materializing.

Hassett may be more tolerant of inflation, seeing the 2% inflation target as a flexible upper limit rather than a strict anchor. The focus would be on employment and GDP growth, reducing the "gradual" decision-making based on data and shifting to a more proactive pro-growth intervention.

In September of this year, during an interview with Fox Business, Hassett stated that the U.S. is experiencing a supply-side boom, in an economy without real inflation, the current rates are hindering economic growth and job creation. He also mentioned that the U.S. is expected to achieve 4% GDP growth.

The viewpoint prioritizing economic growth over inflation control, making it expected for the Federal Reserve under Powell's leadership to restart QE.

Impact on Bitcoin

Every Federal Reserve Chair candidate, whether they directly address the crypto topic or not, will have a structural impact on the cryptocurrency industry. Powell has more than just a passing association with the industry – openly holding Coinbase stock worth millions and serving on Coinbase's advisory board.

Moreover, he participated in an internal White House working group on digital asset policy, pushing for regulatory frameworks that leave room for innovation and seeing crypto tech as a significant variable shaping future economic structures. He once stated that Bitcoin would "rewrite financial rules."

Powell's crypto background could reduce regulatory uncertainty, drive institutional adoption, and lead the Fed to explore crypto integration. This could enhance Bitcoin's legitimacy and liquidity, potentially propelling prices to new highs.

Many traders are bullish on the market post-Powell's appointment, believing that the bull market will start then, expecting this to happen by mid-next year, making the latter half of '26 a focal point for the crypto industry.

You may also like

Key Market Information Discrepancy on February 11th – A Must-See! | Alpha Morning Report

February 11 Market Key Intelligence, How Much Did You Miss?

Analyzing the Impact of Technological Trends in 2026

Key Takeaways The rapid evolution of technology continues to reshape industries, creating both opportunities and challenges. Understanding the…

Navigating Crypto Content Challenges in a Digital World

Key Takeaways Effective content management in the crypto industry involves addressing usage limits and optimizing resources. Staying informed…

Cryptocurrency Exchanges: Current Trends and Future Outlook

Key Takeaways The cryptocurrency exchange market continues to expand, influenced by various global economic trends. User experience and…

Untitled

I’m sorry, but I can’t generate a rewritten article without access to specific content for rewriting. If you…

Crypto Market Dynamics: An In-depth Overview

Market fluctuations provide insights into the volatility and dynamics of cryptocurrency trading. Key market participants play significant roles…

Predicting High-Frequency Trading Strategies in the Market, How to Ensure a Guaranteed $100,000 Profit?

This might be the average person's final opportunity to get ahead of AI

A Day Gathering Wall Street's Old Money: LayerZero's "Mainnet Transition" Narrative

Full Text of CZ's New Interview: From Ordinary Programmer to Richest Chinese, Involvement with FTX, Going to Jail, Doing Charity, Publishing a Book, What is CZ Focus on Now?

Mr. Beast is officially entering the world of finance, the Gen Z's new banker

SBF Appeals from Prison, Files 35-Page Motion Accusing Trial of "Collusion"

Robinhood 2025 Report Card: Earned $45 Billion, Why Did the Stock Price Drop by Half?

$1M+ AI Trading Finals: Hubble AI & WEEX Spotlight the Future of Crypto Trading

The WEEX AI Trading Hackathon Finals are now live, featuring real-time PnL leaderboards, daily rankings, and in-depth AMA sessions. Explore how top AI trading strategies perform under real market volatility and follow the competition as it unfolds.

WEEX Alpha Awakens Final Round Has Officially Begun

Day 1 of the WEEX AI Trading Hackathon Final Round is now live! Watch top algorithmic trading strategies compete with real capital. Follow the action from Feb 3–16, 2026, with $880K+ in prizes. Tune in live now. #AITrading #TradingHackathon

WLFI Team Meeting, Ally Meeting, Seaside Villa Cryptocurrency Business Kickoff

OpenClaw Hackathon, What are some projects worth checking out

Key Market Information Discrepancy on February 11th – A Must-See! | Alpha Morning Report

February 11 Market Key Intelligence, How Much Did You Miss?

Analyzing the Impact of Technological Trends in 2026

Key Takeaways The rapid evolution of technology continues to reshape industries, creating both opportunities and challenges. Understanding the…

Navigating Crypto Content Challenges in a Digital World

Key Takeaways Effective content management in the crypto industry involves addressing usage limits and optimizing resources. Staying informed…

Cryptocurrency Exchanges: Current Trends and Future Outlook

Key Takeaways The cryptocurrency exchange market continues to expand, influenced by various global economic trends. User experience and…

Untitled

I’m sorry, but I can’t generate a rewritten article without access to specific content for rewriting. If you…